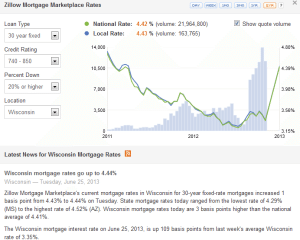

In less than a month the average mortgage rate jumped up to 4.5% from 3.5%. That doesn’t seem like a lot until you do the math. In May the principal and interest on a $250,000 loan would be $1122.61 and that same loan today would be $1266.71 a month. That’s almost a $150.00 increase which is $1,800.oo a year. Rates are expected to keep increasing over the next few months. This will have effects on the price of a house and what a buyer can afford. So 24 hours can have a big effect on the housing market. What does this mean for the average consumer? It means that you may not be able to afford as much house as you would have in May and it means that the serious Buyer is now more motivated to purchase your home if you are looking into selling it. Please be sure to call us if you have been on the fence about the market this year and what your place is in it. 608-658-0467. Looking to sell your home in the near future? Visit SellMyMadisonHome for more information.